Call us today for a Legal Consultation (928) 855-5115

Real Estate Law

- Landlord – Tenant

- Tax Lien Foreclosures

- Homeowner Associations

- Adverse Possession

- Neighbor Law (boundary disputes and nusiance)

- Quiet Title

- Foreclosures/ Trustee Sales

- Transfers to Trusts

- Bad Faith Insurance Claims- denied your claim

- Sale Contract

- Lease Agreement

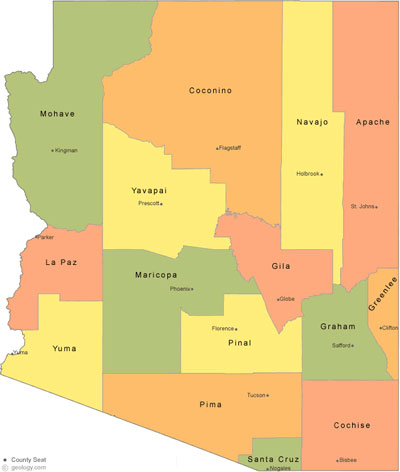

Arizona Property Tax Liens

Each year property owners are required to pay taxes on the property they own. If the owner fails to pay these property taxes, the State of Arizona, through the county treasurer offices sells the taxes owed on a property to the highest bidder. The highest bidder then pays off the taxes owed and is granted a tax-lien on the property. This system was created to assist the state with cash flow problems. Once the private investor has purchased the taxes, the private investor has created a lien on the property. The tax lien holder must wait 3 years before the redemption process end and the foreclosure process starts. The Arizona Revised Statutes has outlined the long and complicated process. For example, the Notice of Intent letter must contain several specific facts and if the letter is deficient, the Notice timeline might not have started. The property owner is then given the opportunity to pay back the investor the amount of tax liens outstanding. If the property owner does not pay the taxes, then the investor can obtain a Treasurer’s Deed to the property after foreclosing on the property. The governing body of law pertaining to tax liens is found in Title 42 of the Arizona Revised Statutes. Title 42 sets forth the process of a lien-sale. If you have purchased a tax lien call Jay Bidwell for a free consultation.

The materials on this website are provided for informational purposes only and do not constitute legal advice. These materials are intended, but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as an indication of future results. Transmission of the information is not intended to create, and the receipt does not constitute, an attorney-client relationship between sender and receiver. The newsletters and articles on this website are offered only for general informational and educational purposes. They are not offered as and do not constitute legal advice or legal opinions. You should not act or rely on any information contained in this website without first seeking the advice of an attorney.

Areas of practice:

- Personal Injury (Car, Motorcycle, Boat, Dog Bites)

- Wrongful Death

- Criminal/ DUI

- Wills, Trusts, Estates and Probate

- Business Law

- Real Estate

- Construction Law

Contact Us by Email

We will never share or sell your email address or phone number.